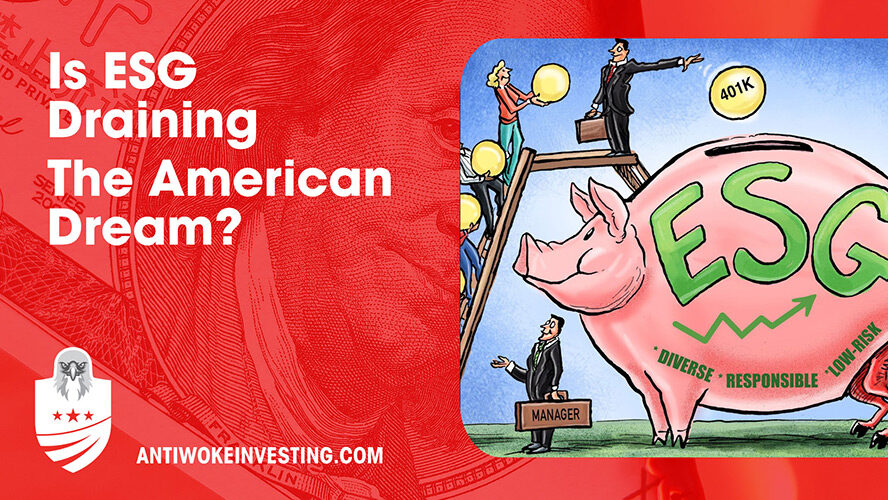

Elon Musk has said himself that ESG is a scam. ESG investing is determined by how compliant a company is with “environmental factors.” ESG stands for Environmental Social Governance, and while that may sound nice on the surface, it is one of the worst investment strategies.

ESG investing has been labeled as “more beneficial to the environment” without ever implementing any changes. ESG companies were less compliant with their own rules than those who don’t associate with ESG companies. (Here’s the study that shows it) So let’s explain how companies who endorse ESG have used a global facade to line their pockets.

A Deep Look at ESG

ESG has been shown to prioritize “sustainable and ethical” efforts. While that may sound good on the surface, the facts have shown that this is furthest from the truth. While it seems good in theory to invest in a company due to its ethical and sustainable future, the research has shown otherwise.

Researchers from the University of Chicago analyzed sustainability ratings of over 20,000 mutual funds worth over 8 trillion of investing savings. At the same time, the highest-rated fund attracted more funds compared to the low-rated funds. None of the higher-rated funds outperformed the lower-rated ones.

So while ESG has been proven to have no financial gain, you may still be interested in investing due to the “ethical positives,” but here are a few things you might be involved in that you might want to consider.

Political Games

The “elites” power has shown time and time again to dish out money to those who seemingly align with the ESG agenda. They’ve been shown to give money to companies like BlackRock, who give the narrative that they align with their specific goals, instead of companies who have been shown to have the highest ROI. So who is losing money when it comes to the thin veil called ESG? American retirees depend on their pensions and retirement funds to be intact.

This is all a test to draw money away from coal, oil, and gas companies that, in the long run, create affordable energy. With hard-working American and these companies being attacked, it leads to energy instability.

Energy Instability

Energy instability leads to economic instability. With things such as the cost of gas skyrocketing, Americans are starting to feel the effects of these absurd policies. Making ESG investing the top priority makes our economy feel significant effects like

- Easrasing good paying jobs

- Increased cost of living

- Wipes out Americans’ Savings

Instead of giving money to people with no interest in investing, we should allow capitalism to run its course and start producing energy in America. Some ESG strategists are even rethinking the implications of investing in ESG.

“We believe [some] ESG funds are revisiting the cost of exclusion [of energy companies] given their underperformance in the first half of 2022 or waiting for regulations to be finalized amid greenwashing fears,” says Menka Bajaj, an ESG strategist at BofA. (original text found here)

With the looming energy crisis, it is likely probability that investing in ESG funds is likely to prove to be even more fatal than previously thought. Rising energy costs due to the “Green New Deal” can cause companies to switch back to fossil fuels which would mean trillions of dollars lost.

The Second Green New Deal

Almost every product that we rely on is made up of fossil fuels. That isn’t even to mention that 80% of our energy comes from fossil fuels. While to the left, it may seem like the end of the world is coming, the United Nations have statistically proved that eliminating all U.S.-based greenhouse gas emissions would have little or no effect on global temperature.

Ultimately, ESG investments are another way for global elites to implement green new deal strategies through capitalistic measures. And while it may seem that these companies have the plant’s best interest at heart, they implement little to no solutions for the problems they are supporting.

Key takeaways

While the idea of ESG funds may be a nice sentiment, the evidence is pretty clear. ESG investing is an investing strategy that you can indulge in if you’re looking for a strategy with little to gain. ESG strategies have been shown time after time to be poor investment strategies. Americans should be wary of the financial validity of a company or investment strategy that promotes ESG. We owe economic stability, public health, and opportunity to the availability of reliable energy.

SOURCES USED:

In brief

And

https://www.forbes.com/sites/peterkrull/2022/10/25/is-esg-really-a-sham/?sh=2ea415935c12

https://www.ft.com/content/c45692c7-8695-438d-9414-33137be91e79